August 19th, 2021

As self-employed mortgage specialists one of the questions we get asked most often is can I get a remortgage while self-employed? In short, the answer is yes!

There are a few things you should know before approaching a self-employed remortgage however, like evidencing your income and the hurdles you might face through the process as a self-employed professional. CMME explains all that and more in this article.

What’s in This Blog?

- Can I get a Remortgage While Self-Employed?

- Evidencing Your Income

- Credit Scoring: a Quick Breakdown

- Loan-to-Value & Why it Matters

- When is it Best to Consider Remortgage While Self-Employed?

- Top Tips for Getting Remortgage Ready

- Useful Resources

Can I get a Remortgage While Self-Employed?

Whether you’re new to the world of self-employed work or you’ve been self-employed for a long time, remortgage might still be foreign territory for you, and it can be a concern since self-employed professionals often experience bias in the mortgage market.

Despite that you should be able to access the most competitive rates for your needs when it comes to your remortgage.

Remortgage in its simplest form means that you review your mortgage terms and make sure they’re still meeting your needs. When you took out your initial rate you (or your broker) most likely made sure that you were on the best possible rate for your needs, and there’s no reason not to do that once you’ve had your mortgage for some time.

Reviewing your rate is a sensible first step to take; whether you ultimately take any further action, it may outline that you could be saving money. Here’s an example:

Breaking down your options (Provided for illustrative purposes only)

Say the offer you’re on begins with an Initial Rate fixed for the first 2 years: 0.87%

After these two years, you will automatically move onto the Lender’s Standard Variable Rate: 3.59%

You don’t have to be a math’s prodigy to estimate, based on those two rates alone, that your monthly payments will be significantly higher on the second rate

The mortgage amount: £350,000

The loan length: 25 years in total

On your initial rate, your monthly repayments are: £1,298.56

On your lender’s standard variable rate your monthly repayments go up to £1,769.12

That’s an extra = £470.56 a month or £5,646.72 a year – needlessly, because you could potentially remortgage to a better rate.

Evidencing Your Income

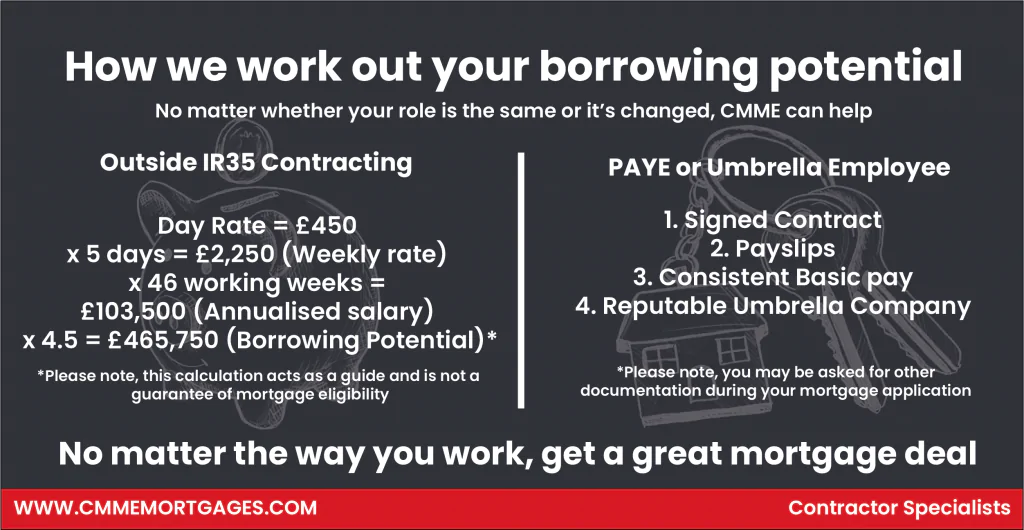

There are a number of ways you, as a contractor, may want to calculate your income to work out your overall borrowing potential:

- Hourly Rate

- Daily Rate

- Annualised Salary

To calculate any of the above simply follow the formula below:

Hourly Rate x Working hours, per day = Daily Rate

Daily Rate x 260 days (working days) = Annualised Salary (Before tax)

Credit Scoring: a Quick Breakdown

Your credit score is essentially the amalgamation of public records and other sources in order to generate a credit report about you and your financial reliability. It’s used by lenders to help decide whether they should lend to you or not. So, whilst it sounds a bit daunting your credit score is something you have a degree of control over, and that starts with being aware of it.

Lenders have become increasingly risk-conscious and are continually on the lookout for reasons not to lend. A good deposit and a satisfactory income are often not enough to secure a mortgage.

That is why it is essential to keep your credit rating up to scratch, leaving the lender no reason to turn you down. It’s important to note that a poor credit score does not guarantee that you will not be approved for your mortgage application – in the same way, a good score does not guarantee approval – though a strong credit score is the first step towards approval.

Here are some quick tips for improving your credit score:

- Register on the electoral roll

- Check for any errors on your credit record and have them removed

- Pay off existing debt

- Don’t do lots of credit checks

- Pay your bills on time, don’t miss payments

Try an app like Credit Karma for keeping track and finding tips for improving your credit score.

Loan-to-Value & Why it Matters

With house prices rising at the fastest rate since 2004, your house might be worth a lot more than it was when you set your current mortgage deal. If that’s the case you may find you’re now in a lower Loan to Value (LTV) band, this means you could be eligible for much lower rates.

Let’s consider that in a bit more depth; the Loan to Value ratio is a hugely important figure for homeowners to be aware of, put simply it’s the to do with the size of the loan relative to your property’s value. This means that if your house is worth more now than it was when you first purchased your home you might be eligible to lower your repayments straight out of the gate.

Naturally this is a double-edged sword, if property prices fall there is a risk that the sale of the property won’t cover your outstanding mortgage balance but certainly market trends suggest that house prices will remain high for some time.

You can read about the potential for a UK housing bubble in our recent article here.

When is it Best to Consider Remortgage While Self-Employed?

There are some key times you might want to reconsider reviewing your mortgage rate:

It’s due for renewal & you’re about to move on to a Standard Variable Rate

When you can see the end of your current deal on the horizon, that’s the prime time to think about remortgage.

When your current rate comes to an end your lender will automatically swap you over to their Standard Variable Rate (SVR) which is more than likely going to be higher than the deal you were on previously.

It’s worth looking at the market because there may well be a better rate out there for you.

The Bank of England base rate is at a historic low

For the time being the Bank of England base rate remains at a historic low, after being slashed in an emergency response to the Coronavirus pandemic early last year the base rate has remained at 0.1% for 16 consecutive months.

How does the base rate relate to your remortgage plans?

Ultimately, the rate as set by the Bank of England’s Monetary Policy Committee influences all interest rates, whether you’re borrowing or saving. This means that whilst it remains at this record low, you may be able to make significant savings on your mortgage repayments, depending on your existing rate and other factors.

There’s never a bad time to review your rate, that is one of the things your lender is unlikely to tell you. And, when you fix your mortgage rate, it’s easy to let your introductory period end and let your rate roll over onto your lenders Standard Variable Rate and forget about it. Why is this an issue? Because homeowners are wasting thousands of pounds a year on unfavourable Standard Variable Rate.

This is because your initial mortgage rate is usually going to be an introductory offer and your SVR is likely to be significantly higher than this initial rate. A mortgage broker will do this for you and present the right product for you.

With the base rate at its current standing now could be a great time to consider remortgage.

There’s Technically no ‘bad’ Time to Review Your Mortgage Deal

Many people let early exit fees stop them from getting the best deal available – whilst exit fees are something you should consider before changing deals, it is frequently the case that the associated savings with your new mortgage rate could be worth accounting for the early exit fees.

As it is likely to be one of your most significant outgoings it makes sense to check you’re not needlessly spending money on your current rate if you could potentially be on a better one.

Top Tips for Getting Remortgage Ready

- Check your credit score

Start by checking your credit score, like we explained, it’s a good idea to go into your application knowing the state of your credit score. This way your broker can give you a realistic sense of what you’ll be able to achieve with youR remortgage and you won’t be hit by any speed bumps in the application process.

- Figure out what you want to achieve

What do you want to achieve with your remortgage? Is your goal to reduce your monthly repayments? To raise additional funds for home improvements or a personal project? Are you uncertain what you’re looking for with remortgage at this stage?

It’s important that you evaluate your priorities before heading into your application,

- Speak to an expert

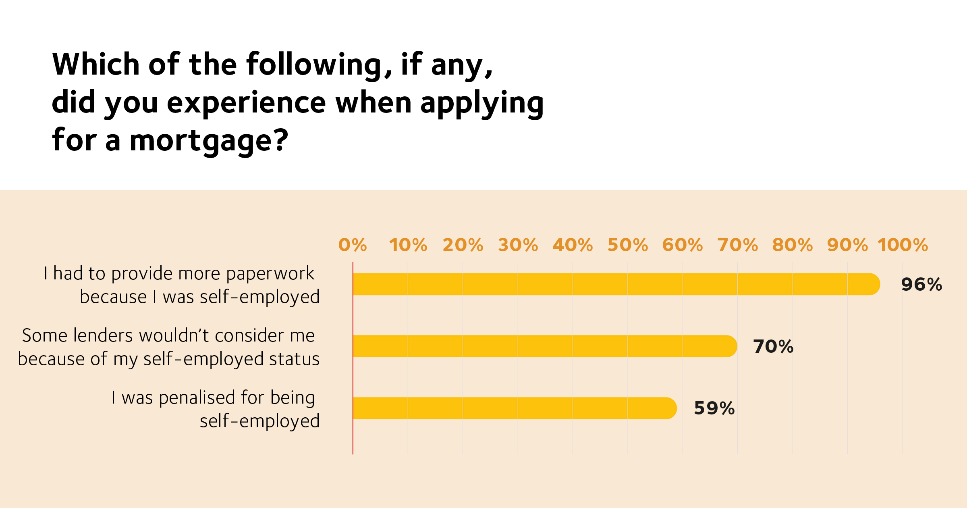

In our 2020 research on self-employed homeownership with IPSE, we found that 96% of respondents had to provide more paperwork when applying for their mortgage because they were self-employed.

These market biases are part of the reason it can be worthwhile for contractors to consider a specialist mortgage broker like CMME, who are using a bespoke process, which means that we can not only help you to raise the borrowing you require for a mortgage, but it also provides you with access to high street lenders and therefore gives you the range of low-level interest rates that would normally be unavailable when looking at a PAYE contractor mortgage.

Try our remortgage savings calculator here to see how much you could save.

Useful Resources

- Base Rate Update: Why Homeowners Should Consider Remortgage | CMME Explains

- Settling Into IR35: The Future for Contractors | CMME

- Getting the Best Mortgage Rate for Contractors | CMME

Whether you want to talk specifics or are just after some general advice, CMME can help. Speak to us today on 01489 223 750 for a completely free, no-obligation mortgage consultation. Or click the button below.