July 1st, 2021

The Base Rate Maintained Again This Month

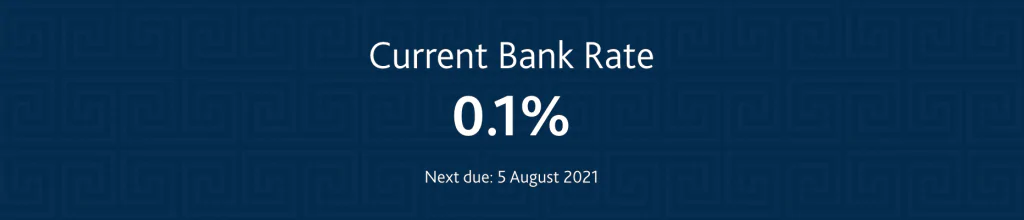

Members of the Monetary Policy Committee for Bank of England have voted unanimously in the meeting ending on 23rd June 2021 to freeze base rate at 0.1% although they expect inflation to reach 3% for a temporary period.

June is the 15th consecutive month with no change to the base rate after its emergency reduction in March 2020 last year – an early response to the pandemic.

One of the major reasons to take interest in the bank rate is its impact on borrowing and saving, particularly with regard to your mortgage plans. CMME explains why now might be a great time to consider remortgage and what the base rate means generally.

What’s in the Blog?

- How is the Base Rate decided?

- Monetary Policy Committee (MPC) meetings

- What are the contributing factors to this decision?

- Reducing Risk of Inflation: why it matters

- The Base Rate & Remortgage

- Reasons to Review Your Mortgage Rate

- Hear From CMME’s Head of Mortgages

- Useful Resources

How is the Base Rate decided?

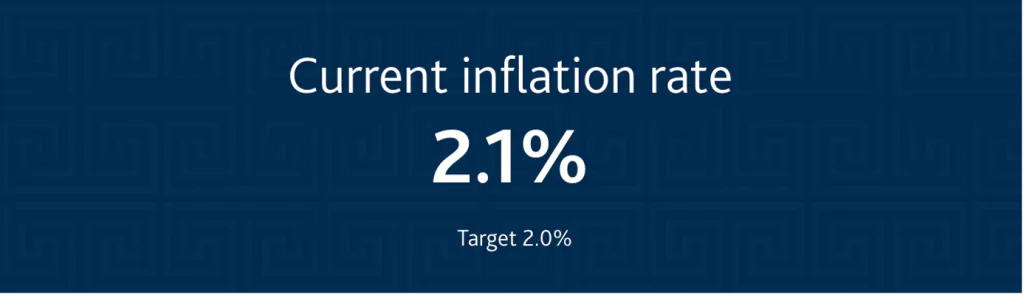

The base rate is set by the Bank of England’s Monetary Policy Committee (MCP) in accordance with inflation targets set by the government. At present, that target sits at 2%, whilst the actual inflation rate has overtaken that goal at 2.1% as of 24th June 2021.

Inflation is expected to pick up further above the target, owing primarily to developments in energy and other commodity prices, and is likely to exceed 3% for a temporary period according to the committee.

Wondering what happens in the process of the MCP deciding these rates? Check out the process below:

Monetary Policy Committee meetings

If you’re interested in the process, this is how our monetary policy is set here in England, it influences everything from the cost of a Freddo to your mortgage rate and more.

Step 1: Pre-MPC meeting

Members are briefed on the latest data and analysis on the economy by Bank of England staff. The briefing includes a report on business conditions around the UK.

Step 2: First meeting

Members discuss the most recent economic data. The meeting is normally held on the Thursday a week before the announcement.

Step 3: Second meeting

Members debate what monetary policy action to take. The meeting is normally held on the Monday before the announcement.

Step 4: Final meeting

The Governor recommends the policy he believes will be supported by the majority of MPC members and the members vote. The meeting is on Wednesday that week.

The MPC’s decision reflects the votes of each individual member, rather than a consensus of the committee. If there is a tie, the Governor casts the deciding vote. Any member in a minority is asked to say what stance of policy they would have preferred.

Step 5: MPC announcement

We publish the MPC’s decision with the minutes of the meetings at 12 noon on Thursday of that week.

What are Contributing Factors to This Decision?

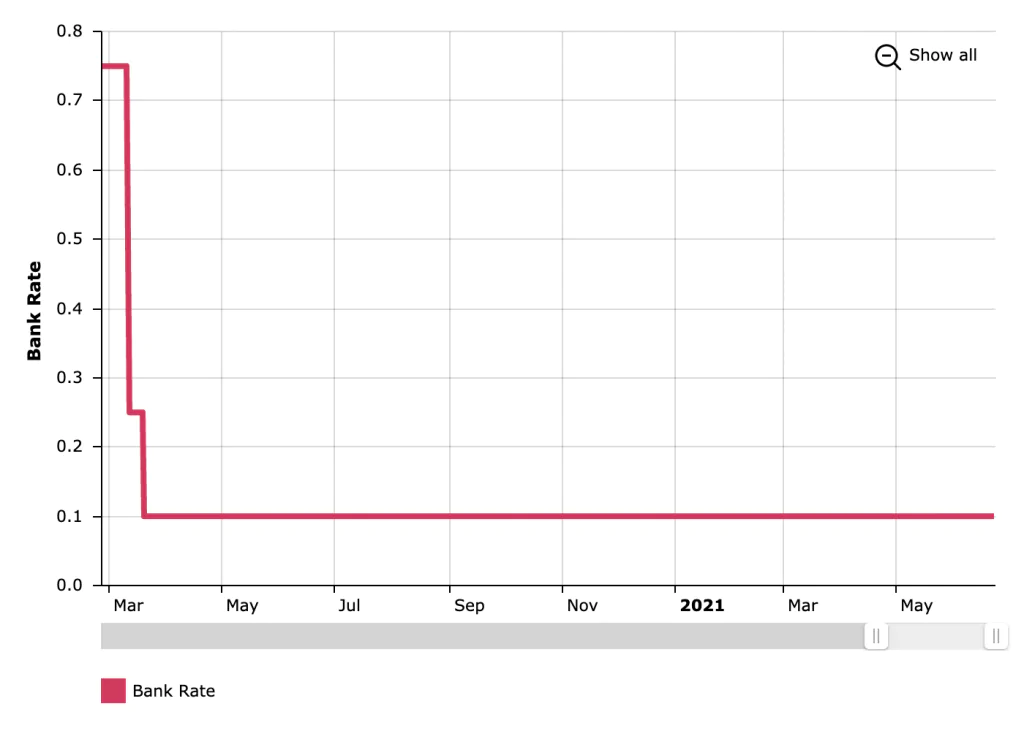

As is the trend in recent months this decision is pursuant to the emergency response to the Coronavirus pandemic early last year when the Bank of England slashed the base rate from 0.75% to 0.25%, and then once further to 0.1% in March 2020, where it has remained at a historic low since.

This was a measure intended to reduce the risk of inflation increasing and the maintenance at this rate continues to support this measure according to the Committee despite the inflation rate ‘temporarily’ rising.

The changes to the bank rate in 2020-2021 from the Bank of England

It is important to note that a small amount of inflation can help to boost economic growth, by encouraging individuals to buy products and thus making it easier for businesses to increase employee wages.

More information about what was discussed in the meeting can be found on the Bank of England website.

The Base Rate & Remortgage

How does the base rate relate to your remortgage plans? In short, it influences all interest rates, whether you’re borrowing or saving. Which means that whilst it remains at this record low, you might be able to make significant savings on your mortgage repayments, depending on your existing rate and other factors.

There’s never a bad time to review your rate, that one of the things your lender is unlikely to tell you. And, when you fix your mortgage rate, it’s easy to let your introductory period end and let your rate roll over onto your lenders Standard Variable Rate and forget about it. Why is this an issue? Because homeowners are wasting thousands of pounds a year on unfavourable Standard Variable Rates.

This is because your initial mortgage rate is usually going to be an introductory offer and your SVR is likely to be significantly higher than this initial rate.

With the base rate at its current standing now could be a great time to consider remortgage, try our remortgage calculator see how much you could save:

Other Reasons to Review Your Mortgage Rate

It can be daunting to think about shopping around for the best deal, especially with a big commitment like your mortgage but there’s a few good reasons to do it (or have a broker do it for you).

When you first organised your mortgage, whether it was for your first property or your fifth, you probably didn’t go for the first option you saw; that’s because it’s a huge financial commitment and one that you’re potentially going to be tied into for a long time.

You (or your broker) more than likely shopped around for that original rate because you’re sensible and you know that your mortgage is where a lot of your money is going to go. After all, your property is an investment for now and also for your future and for your family’s future.

When it comes to reviewing your rate, why wouldn’t you do the same? Making sure your rate is right for you is essential and it’s as important as organising your original mortgage was, even if you’re not moving home.

Need some more reasons why you might review your rate? We have them. There are some prime times you might want to reconsider reviewing your mortgage rate:

It’s due for renewal and you’re about to move on to a Standard Variable Rate

When you can see the end of your current deal on the horizon, it’s a great time to think about remortgage.

When your current rate comes to an end your lender will automatically swap you over to their Standard Variable Rate (SVR) which is more than likely going to be higher than the deal you were on previously.

It’s worth looking at the market because there may well be a better rate out there for you.

Your house has increased in value

With house prices rising at a rapid rate, your house might be worth a lot more than it was when you set your current mortgage deal.

If that’s the case you may find you’re now in a lower Loan to Value (LTV) band, this means you could be eligible for much lower rates.

Important to note:

Many people let early exit fees stop them from getting the best deal available – whilst exit fees are something you should consider before changing deals, it is frequently the case that the associated savings with your new mortgage rate could be worth accounting for the early exit fees.

You’re interested in raising additional funds

When you chose your mortgage originally, you made sure it met your needs. The smart question to ask when it is due for renewal is:

- Does it still work for me?

- Could it release equity to pay for that dream kitchen, or the loft conversion, or home office?

- Could the equity consolidate debts elsewhere and make them easier to manage and your financial commitments more comfortable to live with?

- Would the lump sum pay the deposit on a second investment buy to let property?

The pandemic has made a lot of us review our individual circumstances, whether that’s with a view to our working arrangements or our health, added security has been a priority this year.

Releasing additional funds for home improvements is entirely possible through the remortgage process, making your dreams a very achievable reality.

The MPC will meet again to decide the bank rate on 5th August 2021.

Useful Resources

- What Next After the Stamp Duty Holiday Extension Ends? | CMME

- Settling Into IR35: The Future for Contractors | CMME

- Industry Update: The Budget, New Products & Your Contractor Mortgage | CMME

Whether you want to talk specifics or are just after some general advice, CMME can help. Speak to us today on 01489 223 750 for a completely free, no-obligation mortgage consultation. Or click the button below.