The ability to secure an IT Contractor mortgage has historically been difficult for IT contractors and self-employed IT professionals.

Lenders look extensively for reasons not to lend and tend to perceive contractors to be high risk. They are inclined to overlook the fact that, with their broad skill set; IT contractors are often less of a risk than many permanent employees. Did you know that according to IT Contractors UK there are approximately 1.77 million working as full-time contractors and about 234,000 working on a self-employed basis as their second job?

We have sourced funding for thousands of contractors like yourself, so fully understand the way you operate. With this knowledge, we know exactly who to approach and have underwriting processes in place to ensure you are assessed correctly.

Inside or outside of IR35?

We even have a handy IT contractor mortgage calculator you can use at the bottom of this page, to find out how much you could lend.

We understand that working in the IT sector can be very intense and time-consuming which requires your full attention. It is unlikely that you have the time or flexibility to shop around for a competitive rate and that is something we can do for you.

Our mortgages are specially sourced to help secure funding which is not only competitive in comparison to high street rates, but will also save you valued time and money. In short, we do all the hard work, leaving you to focus on your IT career.

Working in the IT sector can be very intense and your projects require your full attention. It is unlikely that you have the time or flexibility to shop around for a competitive rate, but we are here to take this pressure off you.

We will also help you through the application process. As with other self-employed people, IT contractors cannot rely on professional-grade paperwork already at hand as proof of income. It is also more difficult to meet lenders’ often rigid criteria.

To help you get through the scrutiny you may face at the application stages, we will help you prepare to be in the best possible position. Here are some key ways that you can get ahead when securing an IT contractor mortgage:

When the time comes to make your application, the following proofs of income are often required:

You can gather all of these items independently, but a mortgage broker can help you understand what each lender wants to see and help you improve your chances of being approved.

There are a few different IT contractor mortgages. They work differently and, crucially, each requires you to provide different evidence of income.

An expert adviser can help you understand how these types of IT contractor mortgage work and guide you through the criteria and variables of getting accepted. Not only can this advice help you secure your mortgage, but it can also give you more options to choose from.

The amount you can borrow through your IT contractor mortgage directly impacts the property you’re able to buy. It also affects your monthly repayments and the terms associated with your mortgage. That is why it is important to note that the following things will influence your borrowing capabilities:

At CMME, our specialist advisers will help you prepare your situation for securing a mortgage and point you towards the most suitable lenders for you.

We know that 50% of self-employed borrowers worry that they won’t be treated fairly when applying for a mortgage and that this concern prevents many from trying to buy a property. So, we are here to help you secure the IT contractor mortgage that you are eligible for.

The best way to overcome obstacles is to understand your options and get everything in order to move smoothly through the application process. Our expert mortgage brokers can help you access specialist IT contractor mortgages and weigh up the different deals based on your requirement and what is most realistic for your income profile. Our advice covers these considerations:

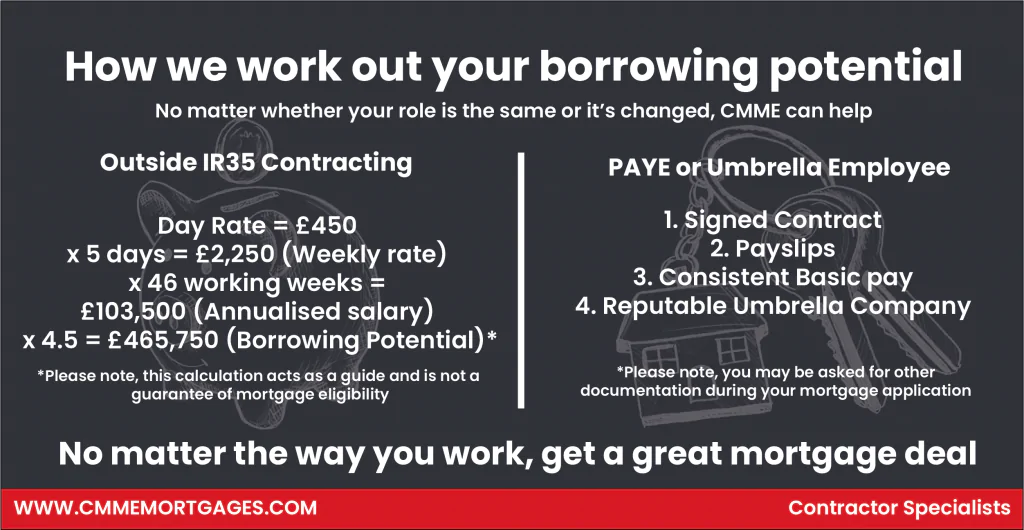

How much can IT contractors borrow?

In the past, lenders would multiply your total income (both you and your partner) by three, four or five to give a maximum mortgage amount. However, this method is no longer seen as a feasible indication of affordability because it doesn’t consider your outgoings. So, now lenders have created their own ways to get a clearer picture of how much you can afford to borrow.

For example, they may assess your current and past income (and want to see future contracts as proof of stable income) and your expenditure to evaluate your maximum loan amount. They will also want to know about your debts, so it can be a good idea to reduce these before you apply for a mortgage. Your mortgage broker will guide you through how to improve your affordability to meet each lender’s criteria.

If you are a IT contractor and looking for a mortgage, take advantage of our IT contractor mortgage calculator to find out how much you could borrow:

For more information on our IT contractor mortgage support, speak to our expert team. Contact us on 01489 223 968 or email us at enquiries@cmme.co.uk

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |