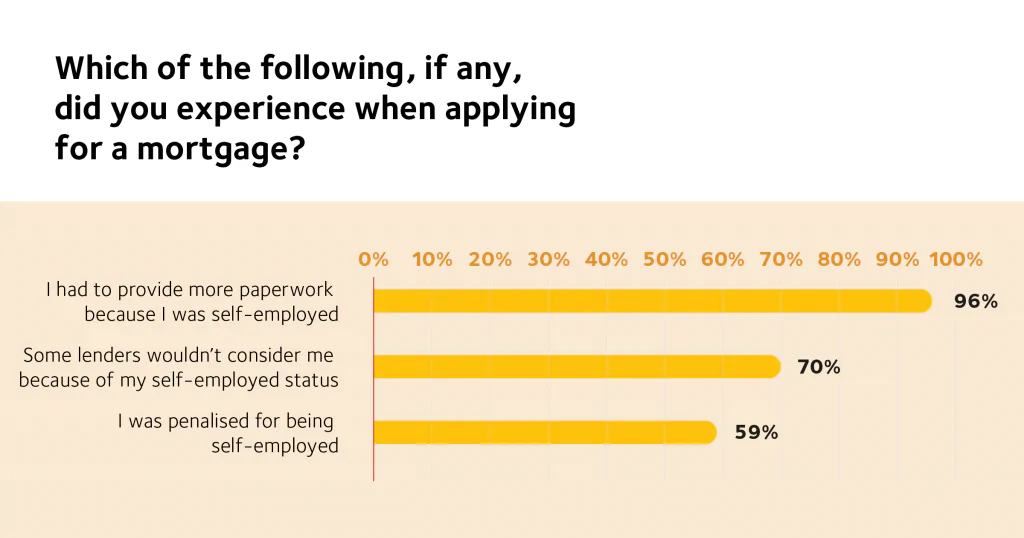

Misconceptions surrounding self-employed mortgages have long been a problem for both self-employed individuals and the lenders that they seek to borrow from. Concerns surrounding everything from affordability to eligibility are certainly behind the reason why 70% of lenders won’t even consider self-employed applicants. They’re also fueling a reality where 50% of self-employed individuals worry about unfair treatment even before their applications.

Unfortunately, our 2020 research with IPSE found that this fear is grounded in fact, with countless self-employed homeowners reporting that they received unfair treatment by high street lenders because of their self-employed status.

CMME want to change that.

We would suggest that any self-employed person seeks specialist and expert advice when considering a mortgage to save time, stress, and money. If a high street lender declines your mortgage application due to the way in which you are paid or your employment status, this can make the process for a specialist mortgage advisor more difficult when it comes to submitting your mortgage application the second time.

You can download our full mortgage guide HERE

This is a goal we’re working towards with 15 years of experience and bespoke underwriting agreements with a wide range of lenders that have already seen us helping thousands of contractors secure the mortgages they deserve. We especially strive to help you realise that you’re worthy of accessing as many lending options as any other borrower regardless of your self-employed status. Our self-employed mortgage calculator plays a crucial role in helping us to do that.

After all, the better you understand your mortgage affordability, the better able you’ll be to answer crucial questions about

your self-employed mortgage prospects, including:

• How much can I realistically afford?

• What type of mortgage should I choose?

• How does the process work?

• What obstacles am I likely to come across as a contractor?

As a self-employed borrower, you will have access to the same mortgage products as any other mortgage borrower. You

can take a look at the best mortgage products that are on offer currently on our best buys table here.

How our self-employed mortgage calculator works

Our easily-accessible online self-employed mortgage calculator provides simple access to an illustrative idea of the lending amounts that you can expect when you dive into the world of mortgage applications. While actual borrowing amounts vary from lender to lender, this is a great starting point for gaining an initial idea of your options and, hopefully, realising that mortgages are within easy reach regardless of how doubtful you’ve felt about your prospects until now.

Whether you want to start your mortgage applications straight away or simply wish to further enhance your understanding of options that you didn’t think you had access to, you can then bring this figure forward with you as you work with our trusted CMME brokers to enhance your lending understanding, and ultimately secure the mortgage you’ve been longing for at last. How lenders assess your income The figure you’ll receive when you use our self-employed mortgage calculator is undeniably useful for illustrative purposes, but it’s also important to realise that lenders factor for many different elements of income before settling on a mortgage offer. Bearing this in mind with the initial figure you receive from our mortgage calculator is your best chance at truly

understanding your options.

Generally speaking, all lenders approach income assessments with different expectations in mind, and our experienced brokers are the best people for helping you to understand how this impacts your specific circumstances. However, the assessment of your self-employed income will vary depending on your unique employment status, and most notably

include:

• Sole traders: Lenders will look at trading history (typically one year, though sometimes 2-3) through the form of accounts prepared by a chartered account. You may also be required to present your SA302 tax calculations for that period.

• Contractors: Lenders will consider the length of contracting employment as well as existing/ongoing contracts. Some lenders will also require up to 3 years of accounts/SA302 calculations.

• Partnerships: Lenders will assess full trading accounts and determine your income by accounting for your percentage of the partnership.

• Company directors: As with sole traders, lenders typically require up to 3 full years of trading accounts/SA302s. Company dividends may also be taken into account.

Expand your borrowing potential with our self-employed mortgage calculator

Here at CMME, we pride ourselves in helping UK based contractors and self-employed individuals to break down the barriers that too often stand in the way of successful mortgage applications. We achieve this with simple, straight-to-the-point advice that starts when you use our self-employed mortgage calculator. Regardless of whether you’re ready to seek the right mortgage solution with the help of our brokers now or in a few months, you can certainly expand your borrowing

potential with this handy online tool in a range of ways, including –

• Better understanding of affordability/interest rates/deposit amounts

• Easier access to budget planning

• Better initial understanding of the mortgage process

• Belief in your lending potential

• And more

The best part of all is that these benefits and more are accessible in moments from the comfort of your own home. So, why not let CMME’s online mortgage calculator help you get started on your self-employed mortgage journey today?

Mortgages for the Self Employed:

• Paperless processes to speed up the process

• Bespoke underwriting agreements

• Specialist expert advice from an experienced consultant

• Mortgage products available from a wide range of lenders

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |