June 15th, 2021

As we approach two months on from the implementation of the changes to IR35 (a year later than the original schedule for these changes) we’re considering what life for contractors looks like post-IR35. What will this mean for your working arrangements and for your mortgage plans?

What’s in This Blog?

- Recapping IR35

- When & why

- The effects

- Know Your Rights When it Comes to IR35

- What Does This Mean for Contractors With Mortgage Plans?

- 5 Tips for Getting Mortgage Ready In 2021

- Protection Following IR35

- Useful Resources

Recapping IR35

When & why

Now, nearly two months on from the implementation of the changes to IR35 we’re recapping what it is and how it will impact you as a contractor.

From the government website, IR35 is summarised as:

From 6 April 2021, all public sector clients and medium or large-sized clients outside the public sector are responsible for deciding your worker’s employment status.

This shift in focus to employers rather than contractors was delayed in 2020 in response to the Coronavirus pandemic. This provided contractors the chance to maintain their role or to secure another on more lucrative terms without having to account for the impact of Covid-19.

The effects

Outside IR35 is what you might think of as the old way of contracting, if you are given this determination, it means that you are responsible for paying the correct amount of tax as will likely have been the case before the changes to IR35 were implemented in the private sector.

Inside IR35 is, put simply, going to mean that you have to be processed by payroll somewhere; this could be through the company hiring your services, through an agency or through an umbrella company.

It’s important to note that for each assignment or contract you take on you will have a separate IR35 assessment, this means that even for existing clients a new determination will need to be made prior to the start of each contract.

Know Your Rights When it Comes to IR35

When you are contracted by a company, what does the process look like now:

Whereas before as a contractor on a day rate you would be hired by a company for services outlined in contract with them and the consideration of tax was primarily your own, now things are different.

You (and the company hiring your services) now need to be aware of whether the work will be identified as either outside or inside IR35 – many companies will have assessments to confirm your IR35 status prior to working for them.

Companies you work with should have ensured that there are written agreements in place for self-employed contractors which reflect the arrangements correctly. It should make your tax status clear and clarify whether the engagement is of a sole trader or a limited company contractor.

Any company you undertake work for should also have an appeals process for contractors who wish to challenge the IR35 determination they are given. If you are unhappy with the determination given following the proper channels of the appeals process, you may be able to reach reasonable adjustments with the company or choose to decline the work if you so wish.

Many companies are seeing more ‘inside’ determinations and contractors should prepare accordingly with options like umbrella companies available to you.

What Does This Mean for Contractors With Mortgage Plans?

Well, first and foremost, it means that you may need specialist help when it comes to getting your mortgage sorted.

Why? Contractors prior to these changes to IR35 already experienced bias in the mortgage market and unfortunately, this has the potential to exacerbate things further.

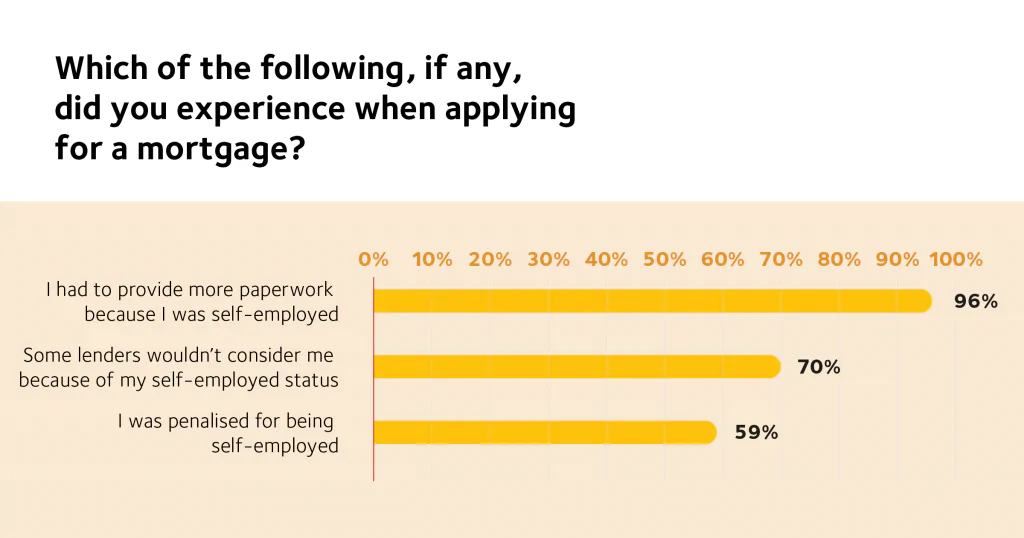

In our 2020 research on self-employed homeownership with IPSE, we found that 96% of respondents had to provide more paperwork when applying for their mortgage because they were self-employed.

The same research revealed over two-thirds were concerned about the impact of IR35 on their mortgage plans. This is understandable because ‘Inside’ determinations may complicate evidencing your pay more than ever before, which can result in high street lenders misunderstanding your income, offering higher rates or reducing borrowing potential.

Many contractors that have experienced this process will be aware that lenders do not fully understand the process used by the umbrella companies and agencies to manage your income.

This often leads to a request for:

- three months’ payslips

- a P60 to be provided

The issue with this is that a lender will only consider the basic pay received and evidenced on the payslip. Some umbrella firms choose to split the regular income to also include partial payments, such as holiday or commission payments.

Mortgage lenders will often discount these payments when assessing your affordability and therefore the income used for assessment will not include the full pay received. This can dramatically decrease the level of lending available when applying for a mortgage.

This is one of the many reasons it can be worthwhile for contractors to consider a specialist mortgage broker like CMME where using a bespoke process means that we can not only help you to raise the borrowing you require for a mortgage, but it also provides you with access to high street lenders and therefore gives you the range of low-level interest rates that would normally be unavailable when looking at a PAYE contractor mortgage.

CMME are the Experts to Have in Your Corner

Here at CMME, we believe everyone should have that freedom to decide their own future. We also know being an independent professional can be really challenging. The price you pay for freedom and flexibility is uncertainty and, when you go looking for support, you may often find that financial providers and conventional businesses just aren’t set up to help. As a growing part of the economy, and a powerful source of expertise, energy, and enterprise, we believe independent professionals deserve better.

Like you, what we do depends on our experience, our expertise, and the relationships we build. Our advisers are specialists in the field and dedicated to serving independent professionals – it takes time to learn how the market works and develop the skills required to find solutions that unlock real value. Our teams are backed up by a rock-solid technology platform and a methodology that we’ve improved and refined over the years. This mix of people and process makes us one of the most agile and efficient in the industry and means we can move at a real pace on your behalf.

5 Tips for Getting Mortgage Ready In 2021

1. Improve your credit score

In light of step one, step two is applying the knowledge that is gained in being aware of your credit score and what sits on your credit report.

Here are some quick tips for improving your credit score:

- Register on the electoral roll

- Check for any errors and have them removed

- Pay off existing debt

- Don’t do lots of credit checks

- Pay your bills on time, don’t miss payments

Try an app like Credit Karma for keeping track and finding tips for improving your credit score.

2. Decide on your budget

In light of Coronavirus, many lenders have reduced the availability of high Loan-To-Value (LTV) mortgages meaning that you will often require a higher deposit than you may have previously, somewhere in the 10-15% range is more prevalent than a 5% in the current climate.

Lenders tend to favour individuals who have higher deposits, but this is true to anyone looking for a mortgage and not just contractors.

To access the most competitive rates you should be aiming to save anything between 10 and 25%. There are mortgage options out there for less than that, but they will be on a much higher rate.

We asked our experts everything you need to know about deposits, check it out here.

3. Get your paperwork sorted

You will need to provide minimal documentation to support your application. Ensure your CV is up to date as it will be used to prove your skills and experience.

You will also need to obtain a copy of your current contract as this will be used to demonstrate your earnings. Using these documents we can avoid any issues to do with affordability.

Our process is a simple as that. We won’t ask you for heaps of documents we might not need, we know the way you work, and we’ll make the process as easy as can be.

We asked our experts everything you need to know about documents, check it out here.

4. Investigate the market

Before you start your mortgage process, it’s a good idea to have a look at the market – investigate what type of mortgage might suit you and your needs, what area would suit you and the costs associated with your new mortgage and property.

Whether this is your first mortgage or your fifteenth, preparing in advance can help make sure your goals are realistic and achievable

5. Speak to a specialist

The truth is that most lenders have little understanding about the contracting market, and as a result, their standardised procedures do not accommodate contractors.

We have agreed bespoke underwriting agreements with a comprehensive range of lenders enabling us to secure mortgage funding based on a multiple of your contract rate alone.

Protection following IR35

As a contractor IR35 will have likely impacted the way you work and whilst you’re considering your role, your income, and your plans for the future it’s important to consider the cover you have in place, particularly if you’re the primary earner in your household.

Ask yourself:

- What protections do you need to consider?

- Are you covered if you were out of work for any reason?

- Is your family protected if something were to happen to you?

- How will you cover your mortgage repayments if you are taken ill?

- Can you increase your peace of mind?

As a self-employed professional, even without considering role changes thanks to IR35, it can be a worrying time if you find yourself unable to work due to injury or ill-health.

Now, as the dust begins to settle following the changes to IR35, you should ask yourself, what types of financial protection should I consider as a self-employed professional?

This is a non-exhaustive list of the protections you might consider:

Income Protection

This replaces part of your income if you are unable to work for a long period of time because of illness or disability:

- You can potentially insure up to 60% of your current income (salary and dividends)

- Your take-home payments will be tax-free, as the tax is paid on premiums

- A bespoke plan is built around your unique needs and budgets

Critical Illness Cover

Critical illness cover pays out a lump sum if you’re diagnosed with a critical illness. This can provide peace of mind when what you need to focus on is your health. You can use the pay-out for anything such as payments for medical treatment or to pay off your mortgage.

Life Insurance

Life insurance ensures that your family is take care of in the unfortunate event of something happening to you.

Useful Resources

- The Contractor’s Guide To Help To Buy Mortgages | CMME

- Contractor Mortgage, Calculators and Tips for 2021 | CMME

- Industry Update: The Budget, New Products & Your Contractor Mortgage | CMME

Whether you want to talk specifics or are just after some general advice, CMME can help. Speak to us today on 01489 223 750 for a completely free, no-obligation mortgage consultation. Or click the button below.