March 4th, 2020

An Update and A Recap: 01/04/2021

With the changes to IR35 just a week away, we’re revisiting an article we wrote last year prior to the announcement that the changes would be delayed to April 2021.

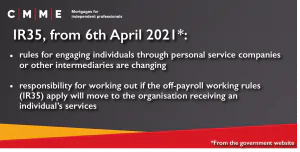

The proposed changes that will come into effect next week were originally raised in the October 2018 budget by the then Chancellor of the Exchequer, Phillip Hammond – in the budget, the change was detailed as:

“Off-payroll working in the private sector

To help people comply with the existing rules and bring private sector organisations in line with public-sector bodies and agencies, the government will reform the off-payroll working rules (known as IR35) in the private sector.

This follows consultation and the roll-out of reform in the public sector. Responsibility for operating the off-payroll working rules will move from individuals to the organisation, agency or other third party engaging the worker. To give people and businesses time to prepare, this change will not be introduced until April 2020.

Small organisations will be exempt, minimising administrative burdens for the vast majority of engagers, and HMRC will provide support and guidance to medium and large organisations ahead of implementation.”

The changes were then delayed until 6th April 2021 – next week.

Many things were postponed due to Covid-19 and one of them was the tabled amendments to IR35 legislation. This was helpful to contractors for many reasons but particularly due to the fact that for many it provided the chance to maintain their current role throughout the height of the pandemic or to secure another on more lucrative terms.

What’s In The Blog?

What’s In The Blog?

- What Is IR35 & How Will It Impact Contractors And Freelancers?

- Are There Any IR35 ‘Red Flags’?

- So, Is Getting A Mortgage Still Possible After I Move Into IR35?

- Useful Resources

![]()

Original blog, published: 4/03/2020 (All content was correct at the time of publishing)

What Is IR35 & How Will It Impact Contractors And Freelancers?

IR35 is a legislation that is used by Her Majesty’s Revenue and Customs (HMRC) to determine what kind of tax contractors should be paying. It is designed to deter people from claiming to be contractors when they are working full time at one company.

Workers usually do this so they can pay a lower rate of tax than a normal employee would. If the individual is caught, HMRC may charge a percentage of the unpaid tax. This may mean a change in how individuals are scrutinised when making future financial applications, due to changes in pay and tax.

Companies can frequently ask contractors to invoice them through a limited company instead of invoicing in their own names. Companies do this so that they are not liable in case your tax is paid incorrectly – they also do it so that it looks like they don’t employ the contractor full-time, the latest IR35 news suggests.

Generally, You May Be Affected If You Are:

- a worker who provides their services through their intermediary

- a client who receives services from a worker through their intermediary

- an agency providing workers’ services through their intermediary

Full details on IR35 can be found on the government website

The purpose of IR35 is to ensure that contractors and freelancers working via their own limited company are paying the correct amount of tax, HMRC uses IR35 to make sure those who work in a similar capacity to a full-time employee are paying the same amount of income tax and national insurance.

HMRC will determine the status of individuals based on questions about their working practice.

There are a number of changes happening to IR35 legislation (also known as off-payroll tax) in April 2021.

IR35 is already enforced across the public sector – however, it will soon be enrolled in the private sector too. If you work in a private sector, it’s important to apply the new IR35 into your business strategy if you think it will affect you.

By doing this, you will be protected from a legal standpoint if HMRC ever does an investigation into your working practices.

We have summarised the potential problems that could come up for many freelancers and contractors if the new off-payroll tax is applied to their income.

![]()

Are There Any IR35 ‘Red Flags’?

When IR35 legislation is rolled out in April 2021, the end client business will determine the working status of their contractors. Previously, contractors would have been able to determine this for themselves.

This will leave contractors and freelancers financially vulnerable if their working practices are changed. For example, if contractors are deemed as ’employees’, they’ll be expected to pay a higher rate of tax including income tax and national insurance.

This could result in contractors having less disposable income – meaning that they may not be able to afford a mortgage or keep up with repayments.

Some lenders may also look at the change in circumstance from contracting to PAYE or umbrella as the complexities around the change of income may not fall into the standard lending criteria they use with the general public.

As a result of a contractor going inside IR35, they may think more about their lifestyle. As tax changes come into place it may not be possible to expense things like travel.

This may cause workers to think about relocating to reduce the cost of living. In a worst-case scenario, some contractors may end up leaving their sector and may try to seek employment elsewhere.

![]()

So, Is Getting A Mortgage Still Possible After I Move Into IR35?

As part of the everchanging landscape of contractor, PAYE, Umbrella or freelance working you may find that securing a mortgage directly may have certain pitfalls and criteria, which can be difficult to navigate.

As a mortgage broker that specialises in complex cases CMME utilises several methods for securing an application.

The first step is to provide sufficient income evidence for a lender, to confirm that your affordability range is higher than the salary and dividend income would initially suggest is the case. This is usually done from a current contract. We will also ask for a copy of a current and up to date CV.

The method used to determine your personal income varies from lender to lender, but in essence, we will agree with an underwriter a level of income that is deemed to be acceptable for you, by annualising either your hourly or daily rate of pay.

By doing this, we are able to provide you with the means to use the majority of the income that you are receiving from your umbrella company to demonstrate to the lender that affordability should not be a concern.

![]()

Useful Resources

- The Contractor’s Guide To Help To Buy Mortgages | CMME

- Contractor Mortgage, Calculators and Tips for 2021 | CMME

- Industry Update: The Budget, New Products & Your Contractor Mortgage | CMME

Whether you want to talk specifics or are just after some general advice, CMME can help. Speak to us today on 01489 223 750 for a completely free, no-obligation mortgage consultation. Or click the button below.