April 28th, 2021

The Impact of the Pandemic on the Mortgage Market

Cast your mind back to early 2020 when we had no idea what the next year would hold. Think back to a time before lockdowns and queues for supermarkets (for everything, actually) and now think about the present day – what work looks like, or socialising, or popping to the bank.

It’s fair to say a lot has happened in a relatively short space of time and though it may feel like a lifetime, here we are over one year on from the beginnings of COVID-19. Today we’re talking about the impact of the pandemic on the mortgage market and, importantly, for contractors and the self-employed.

What’s in the Blog?

- Looking Back at the Pandemic so far

- March 2020 – April 2021

- What’s Happened in the Market?

- Stamp Duty Land Tax Holiday

- A Buoyant Housing Market

- 95% Mortgage Guarantee Scheme

- SEISS

- Green Homes Grant

- The Impact of the Pandemic: in Summary

- Useful Resources

Looking Back at the Pandemic so far

Now, over a year since our first national Coronavirus lockdown, it’s a good opportunity to consider the impact of the pandemic.

It’s hard to imagine a world where you might have missed the impact of the virus unless perhaps you’ve been away on the Space Station for the last year and a bit (if that is the case, hi, welcome back) but let’s recap.

March 2020

March saw the first UK lockdown and the mortgage market freeze – as things came to standstill, one of the early and noticeable impact of the pandemic, demand began to build. Experts aired concerns about the impact of this on the housing market however this was much the same state for most UK businesses as adaptations to the way we work had not yet come into place.

Our 2020 research with IPSE found that 63% of respondents who were planning to become homeowners in the next five years were concerned about the state of the UK housing market.

However, it’s worth noting that the market took a significant upswing after the uncertainty of the early stages of the pandemic.

Headlines in this month included:

- PM: “Stay at home, this is a national emergency” – The Guardian

- Britain on Lockdown – The Metro

- Johnson forced to close Britain in bid to halt rapid virus spread – The Financial Times

July 2020

With July came the introduction of Chancellor Rishi Sunak’s Stamp Duty Land Tax holiday – intended to stimulate the market post lockdown. It has been an effective and popular scheme since its announcement, incentivising homebuyers with larger deposits and higher property values as their savings have been the most significant.

Headlines in this month included:

- Holiday chaos: 14M Brits to stay at home – Daily Mirror

- Virus outbreaks raise fears of second wave in Europe – The Guardian

- Quarantine to be cut to 10 days – The Daily Telegraph

September 2020

In September, house prices hit record high for the first time, setting a trend of new records for the proceeding months. With the market stimulated and with work from home increasingly common place, lots of home buyers sought green spaces, bigger gardens and properties outside of the city.

Headlines in this month included:

- Whitty to warn virus at ‘critical point’ in UK – The Independent

- Threat of two-week social lockdown – The Evening Standard

- Global deal to roll out snap Covid tests worldwide – The Guardian

November 2020

As the second national lockdown was announced for the UK many feared that it would affect the mortgage market as the first had.

This was not the case.

The market continued to be stimulated and active with virtual valuations and home viewings. Lender’s criteria changes impacted buyers and November continued to see the reduced availability of higher Loan-to-Value (LTV) products for borrowers.

Headlines in this month included:

- Johnson’s U-turn puts country under tough new lockdown – The Observer

- Lockdown XMAS fears – Daily Mirror

- Vaccines are safe path to freedom – The Evening Standard

December 2020

2020 ending was a relief for many, needless to say, it was a hard year for a lot of us. The holiday season bought fears of cancellation with the national tiered lockdown meaning solitary celebrations for many. The end of the year also bought hope for 2021 as talks of vaccines coming to fruition increased.

Headlines in this month included:

- Rapid covid spread puts family Christmas at risk – The Independent

- We’re all heading for tier 4 – Daily Mail

- Impose national lockdown or risk ‘human disaster’, scientist warn PM – The Guardian

January 2021

Still in national lockdown, January bought in the new year and the housing market stayed buoyant, with the scheduled end of the Stamp Duty holiday approaching many home buyers began rushing to take advantage of the potential savings associated.

Headlines in this month included:

- Jabs for all – Daily Star

- Mutant strain ‘more deadly’ – The Daily Telegraph

- Strength of UK key to Covid recovery, Johnson – The Scotsman

March 2021

March came as a relief to many of us as lockdown began to lift and presented more opportunities for time outside of our homes. This month also include the 2021 spring budget which included announcements about:

- Stamp Duty Holiday to be extended

- 95% Mortgage guarantee scheme

- Self-Employed Furlough scheme continued

The Chancellor stated he will do “Whatever it takes” to ensure the future of the economy and the introduction of several schemes for the property and mortgage market could ensure current and potential homeowners do not have to derail their plans due to the pandemic.

Headlines in this month included:

- Rishi: I’ll keep spending to get Britain moving – Daily Express

- Britain faces ‘significant’ Covid vaccine shortage – The Independent

- Back to the life we love – Sunday Express

April 2021

Now we’re approaching the end of April and we’re looking at the year ahead and predictions are difficult to make at this stage but generally speaking we’re hopeful for the year ahead.

Hear from CMME’s head of mortgages, Simon Butler, on the rest of 2021:

“It’s likely that the outlook for the mortgage market in 2021 is tied closely to the success of the Covid vaccine roll out. Interest in the property and mortgage sector unsurprisingly increased once the road out of lockdown was introduced, so the roll out of the vaccine will hopefully embolden property owners to begin moving home once again.

The current lack of available property is holding the market back a touch, but freedom of movement and a more prosperous outlook in the employment sector will play a major part in boosting the economic recovery”

Headlines in this month included:

- Keep calm and carry on jabbing – Daily Mail

- Two thirds want to return to office – The Evening Standard

- Smile! No masks by the summer – Daily Express

What’s Happened in the Market for Self-Employed Professionals?

Stamp Duty Land Tax Exemption

Stamp Duty Land Tax is one of the various costs that homebuyers ordinarily need to account for when buying a home, however, with the current stamp duty exemption buyers can stretch their cash further and get more house for their money. Chancellor Rishi Sunak announced the extension of the Stamp Duty holiday (implemented last year) which was due to end shortly, at the end of March 2021.

This has now been delayed until the end of June 2021 giving homebuyers extra time to benefit from the associated savings attributed to the Stamp Duty Holiday.

A Buoyant Housing Market

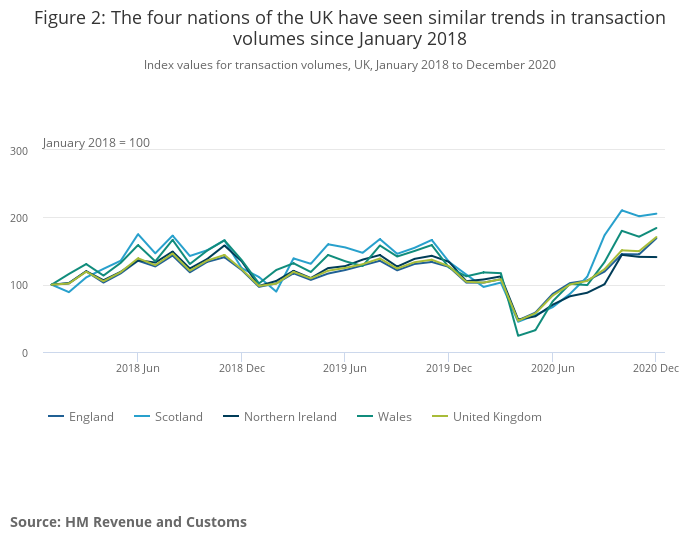

Though activity in the housing market slowed in the early part of 2020 the graph below from the Office of National Statistics demonstrates the significant up-turn in house prices in correlation to market activity (see Fig. 2) in the latter part of the year.

Much of this stimulation is thought to be attributed to the Stamp Duty holiday and also in the renewed confidence of home buyers after some trepidation following the first national lockdown here in the UK.

95% Mortgage Guarantee Scheme

First-time buyers, home movers and previous homeowners with a 5% deposit will be able to access 95% Loan to Value (LTV) mortgages under the new scheme announced in the March budget by Chancellor Rishi Sunak. The new scheme, not dissimilar to the 5% Help to Buy Government scheme that ran 2013-2017, will run from April-December 2022. The key difference between the ongoing Help to Buy scheme, which is focused on new build property only, is that this provides buyers the opportunity to purchase existing homes with a smaller deposit.

To be eligible for a guarantee under the scheme; the mortgage will need to:

- be a residential mortgage (not second homes) and not buy to let

- be taken out by an individual or individuals rather than an incorporated company

- be on a property in the UK with purchase value of £600,000 or less

- be a repayment mortgage and not interest-only

Self Employed Support Scheme

Early into the pandemic, there were, rightfully, many concerns for the self-employed. Our research found that 75% of self-employed respondents were worried that they would not have enough job security to get a mortgage.

As such, if you’re self-employed and have been affected by the pandemic, you may have been eligible to claim a grant though the Self-Employment Income Support Scheme (SEISS).

The SEISS first opened in May 2020 and was worth 80% of past average monthly trading profits for those eligible. Following that, a second grant worth 70% was opened in August and closed for applications on 19 October and a third SEISS grant, worth 80%, was opened to claim on or before 29 January.

The fourth SEISS grant will cover the three-month period from the start of February until the end of April but the application process and eligibility requirements have now changed compared to previous SEISS payments.

From the Government website:

To be eligible for the fourth grant you must be a self-employed individual or a member of a partnership. You cannot claim the grant if you trade through a limited company or a trust.

You must have traded in both tax years:

- 2019 to 2020 and submitted your tax return on or before 2 March 2021

- 2020 to 2021

You must either:

- be currently trading but are impacted by reduced demand due to coronavirus

- have been trading but are temporarily unable to do so due to coronavirus

You must also declare that you:

- intend to continue to trade

- reasonably believe there will be a significant reduction in your trading profits

There will be a fifth grant covering May 2021 to September 2021 continuing to support those feeling the impact of the pandemic.

Green Homes Grant

Chancellor Rishi Sunak first announced the Green Homes Grant in July 2020, with the aim of upgrading the energy efficiency of homes in England, supporting low carbon heating technology and helping to reduce the number of people who cannot afford to heat their homes. Though the £1.5bn scheme only launched in September 2020 been set to run until 31st March 2022 it was scrapped having reached just 10% of the 600,000 homes chancellor Rishi Sunak outlined would be improved.

The idea behind the grant was to give homeowners in England vouchers to help cover the cost of energy efficiency improvements to their home – such as low-carbon heating systems, insulation, or double glazing to replace single glazing.

In Summary: The Impact of the Pandemic

The last year has been one for the history books no doubt. For contractors and the self-employed, it has presented more challenges than ever, especially to those feeling the impact of the pandemic. However, as we look forward to the rest of 2021 and further to next year, the outlook for home buyers and the self-employed is bright.

Useful Resources

- Ask the Expert: Deposits & Documents

- Industry Update: The Budget, New Products & Your Contractor Mortgage | CMME

- Self Employed Mortgage: What, How & Why? | CMME

Whether you want to talk specifics or are just after some general advice, CMME can help. Speak to us today on 01489 223 750 for a completely free, no-obligation mortgage consultation. Or click the button below.