March 18th, 2021

The Base Rate has been maintained today

As we look ahead to the lifting restrictions in this latest lockdown, the Bank of England (BoE) announced that the base rate would maintain its position at 0.1%.

At its meeting ending on 17 March 2021, the Committee judged that the existing stance of monetary policy remains appropriate. The Committee voted unanimously to maintain the Bank Rate.

What’s In The Blog?

- Where Has This Decision Come From?

- Reducing The Risk Of Inflation?

- What Does That Mean If You Are A Contractor Looking To Secure Mortgage Finance?

- Hear From CMME’s Head of Mortgages

- Useful Resources

Where Has This Decision Come From?

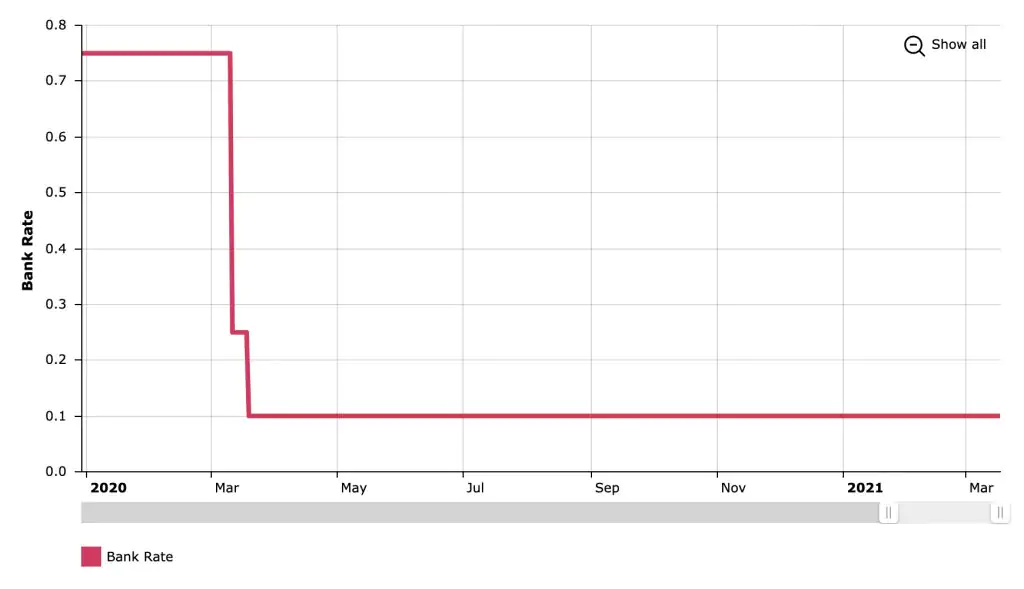

This comes further to the emergency response to the Coronavirus pandemic earlier this year when the Bank of England slashed the base rate from 0.75% to 0.25%, and then once further to 0.1% in March 2020, where it remains at a historic low.

This was a measure intended to reduce the risk of inflation increasing and the maintenance at this rate continues to support this measure.

The changes to the bank rate in 2020-2021 from the Bank of England

Reducing The Risk Of Inflation?

The Bank of England’s Monetary Policy Committee (MPC) meet to vote on a number of monetary policies, including the base rate, to discuss how to meet the 2% inflation target set by the government.

In doing so they also aim to help sustain growth in the UK economy and employment. In yesterday’s meeting the Committee judged that the existing stance of monetary policy remains appropriate and voted unanimously to maintain the bank rate at 0.1%. More information about what was discussed in the meeting can be found on the Bank of England website.

This, in addition to the bank rate, ultimately mean that the mortgage market can maintain its healthy stimulated position as we move forward.

It is important to note that a small amount of inflation can help to boost economic growth, by encouraging individuals to buy products and thus making it easier for businesses to increase employee wages.

What Does That Mean If You Are A Contractor Looking To Secure Mortgage Finance?

Is now a good time to action your mortgage or remortgage plans?

According to Which? there is a lot of optimism surrounding the property market at present, and Rightmove currently forecasts that house prices will rise by 4% this year, though predicts a lull once the stamp duty cut ends, but says this won’t be ‘make or break’. There are many factors that support considering a review of your current mortgage terms.

For home buyers, the Bank of England base rate affects all loan and mortgage interest rates in the UK. By maintaining the current BoE base rate at 0.1% borrowing is cheaper, but it also means that the returns on savings will be less as well.

A low base rate means lenders can continue to offer low-interest rates for borrowers. When accounting for this and the stamp duty holiday, now could also be a great time to consider remortgage, home buying or property investment.

Remortgage

This may be the perfect time to review your circumstances, with the rate remaining at this historic low, remortgage could potentially save you money by reducing your monthly repayments.

Some reasons you might consider remortgage:

✓ Raise funds for home improvements, such as kitchen refurbishment, loft and conservatory conversions

✓ Lower your monthly payments, with historically low mortgage rates from 1.20%*

✓ Relieve financial stress, with an extra budget for your monthly outgoings by moving to a potentially better deal

In addition to this, with house prices still on the rise, your house may be worth more now than when you originally took out your current mortgage deal, meaning you could potentially take advantage of being in a more favourable loan to value (LTV) bracket to remortgage or raise additional funds at a lower interest rate.

Check out CMME’s free remortgage guide for contractors here.

Home Movers

A low base rate means that lending is more affordable than ever, why not try our calculator to see how much you could borrow?

Your 2021 mortgage dreams could be a reality with CMME.

Hear from Simon Butler – Head of Mortgages for CMME, he said:

““The tone of the Chancellor’s Spring budget 2021 appeared to be an act of reassurance and persuasion for first time buyers to return to the property market.

The double boost of a longer stamp duty holiday and Government support to encourage lenders to offer higher loan to value mortgages is a clear call to action for new homeowners.

Given that outlook, it would be less reassuring to see interest rates increase, not least because there is ongoing concern that unemployment levels may spike in the coming months.

There are other factors at play, not least the impact of Brexit on trade, but for these key reasons the Bank Of England are likely to again vote for maintaining interest rates at the current level.”

The MPC will meet again to decide the bank rate on 6th May 2021.

5 Top Tips To Maximise Your Mortgage Potential in 2021

1. Improve your credit score

In light of step one, step two is applying the knowledge that is gained in being aware of your credit score and what sits on your credit report.

Here are some quick tips for improving your credit score:

- Register on the electoral roll

- Check for any errors and have them removed

- Pay off existing debt

- Don’t do lots of credit checks

- Pay your bills on time, don’t miss payments

Try an app like Credit Karma for keeping track and finding tips for improving your credit score.

2.Decide on your budget

In light of Coronavirus, many lenders have reduced the availability of high Loan-To-Value (LTV) mortgages meaning that you will often require a higher deposit than you may have previously, somewhere in the 10-15% range is more prevalent than a 5% in the current climate.

Lenders tend to favour individuals who have higher deposits, but this is true to anyone looking for a mortgage and not just contractors.

To access the most competitive rates you should be aiming to save anything between 10 and 25%. There are mortgage options out there for less than that, but they will be on a much higher rate.

We asked our experts everything you need to know about deposits, check it out here.

3.Get your paperwork sorted

You will need to provide minimal documentation to support your application. Ensure your CV is up to date as it will be used to prove your skills and experience.

The average time spent looking at a CV by recruiters is only 5-7 seconds.

You will also need to obtain a copy of your current contract as this will be used to demonstrate your earnings. Using both of these documents we can avoid any issues to do with affordability.

Our process is a simple as that. We won’t ask you for heaps of documents we might not need, we know the way you work, and we’ll make the process as easy as can be.

We asked our experts everything you need to know about documents, check it out here.

4.Investigate the market

Before you start your mortgage process, it’s a good idea to have a look at the market – investigate what type of mortgage might suit you and your needs, what area would suit you and the costs associated with your new mortgage and property.

Whether this is your first mortgage or your fifteenth, preparing in advance can help make sure your goals are realistic and achievable.

For an idea of what’s coming up this year for contractors, which might affect you and your mortgage plans, take a look at our recent article here.

5.Speak to a specialist

The truth is that most lenders have little understanding about the contracting market, and as a result, their standardised procedures do not accommodate contractors.

We have agreed bespoke underwriting agreements with a comprehensive range of lenders enabling us to secure mortgage funding based on a multiple of your contract rate alone.

Useful Resources

- The Contractor’s Guide To Help To Buy Mortgages | CMME

- Contractor Mortgage, Calculators and Tips for 2021 | CMME

- Industry Update: The Budget, New Products & Your Contractor Mortgage | CMME

Whether you want to talk specifics or are just after some general advice, CMME can help. Speak to us today on 01489 223 750 for a completely free, no-obligation mortgage consultation. Or click the button below.