March 3rd, 2021

Stamp Duty Holiday Extended In Spring Budget Review

The Stamp Duty Holiday has been extended today ahead of the original end date in March 2021. The holiday was implemented initially as a way to stimulate the market following the first lockdown almost a year ago.

What’s In The Blog?

- The New Stamp Duty Terms

- Recapping Stamp Duty Land Tax

- What Does The Stamp Duty Holiday Mean?

- Hear From CMME’s Head of Mortgages on The Budget Review

- Useful Resources

The New Stamp Duty Terms

The Chancellor has extended the Stamp Duty holiday which was due to end this month until the end of June.

Chancellor Rishi Sunak is using the Budget to extend the Stamp Duty Tax holiday in order to support the property market as the UK recuperates following the economic impact of lockdown, The Times has said extending the policy could cost the Treasury around £1bn.

Was The Stamp Duty Holiday A Success?

The stimulus that the stamp duty holiday gave to the housing market has been seen as a general success, with house purchases increasing and lending reaching a 6.8% increase compared to the previous year according to the ONS.

However, due to the positive stimulus in the housing market this also increased average house pricing by an average of 8.5% in the same report from the ONS and Bank of England.

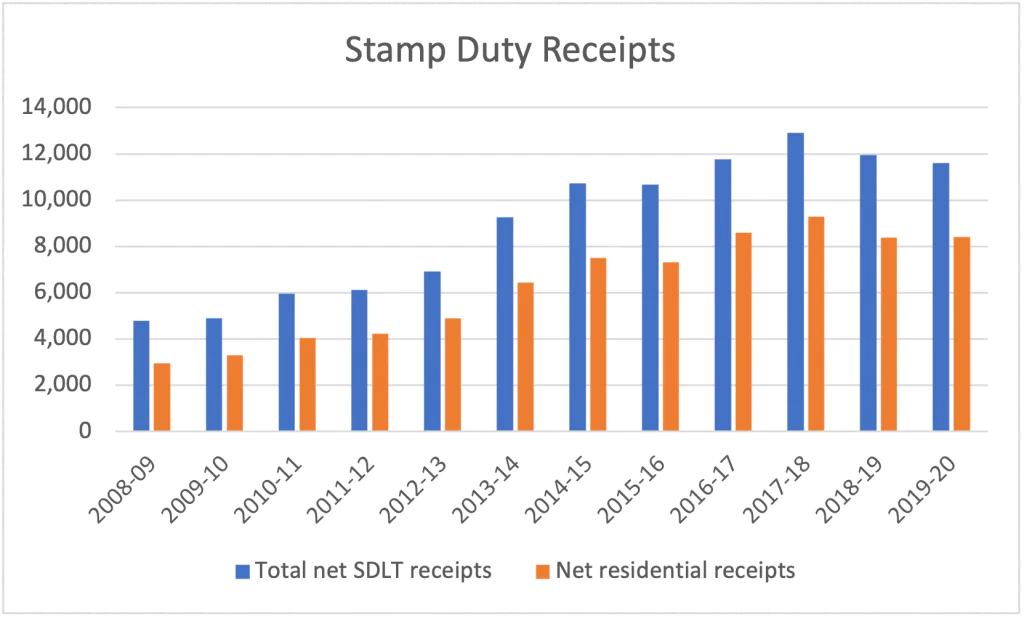

When looking at past numbers of stamp duty collected from overall and residential properties, it’s clear that although the Holiday introduced was designed for people not to pay the fee, due to the increase in demand and only being available for properties valued below £500k the amount of stamp duty paid is fairly flat compared to previous 2-year period.

(Source: Gov.uk)

Recapping Stamp Duty Land Tax

To recap, Stamp Duty Land Tax is one of the various costs that homebuyers ordinarily need to account for when buying a home, however, with the current stamp duty exemption buyers can stretch their cash further and get more house for their money.

The idea behind the threshold change was to stimulate a market that had reached a standstill involuntarily in response to COVID-19. And it has been successful.

As a considerable boon to homebuyers, an extension on the holiday will mean that the pressure on buyers to complete their mortgages before the deadline will be lifted.

Many homebuyers have benefited from the additional savings over the last year which increase exponentially based on the cost of the house.

What Does The Stamp Duty Holiday Mean For Contractors?

Put simply, the holiday means extra funds thanks to the associated savings which increase exponentially as your property price increases.

When it comes to your mortgage application though, it’s important to remember that as it stands, a mortgage lender will not loan additional funds to cover the cost of Stamp Duty.

Before considering a property purchase you will need to hold sufficient equity within your existing property or money set aside specifically to cover the costs of completing a move.

It’s essential to remember this can include removal fees, solicitors’ fees and, of course, Stamp Duty.

Stamp duty is not often a significant factor for a lender assessing a mortgage application, however, the potential saving of thousands of pounds in Stamp Duty charge will impact how much you are able to include a deposit.

Arguably this is the biggest benefit for new purchasers as the extended temporary removal of the charge could provide the opportunity to secure a lower interest rate.

| Property price | Previous stamp duty bill | Revised stamp duty bill | Stamp duty saving |

| £0k – £200k | £0.5k – £1.5k | £0 | £0.5k – £1.5k |

| £200k – £250k | £1.5k – £2.5k | £0 | £1.5k – £2.5k |

| £250k – £300k | £2.5k – £5k | £0 | £2.5k – £5k |

| £300k – £350k | £5k – £7.5k | £0 | £5k – £7.5k |

| £350k – £400k | £7.5k – £10k | £0 | £7.5k – £10k |

| £400k – £450k | £10k – £12.5k | £0 | £10k – £12.5k |

| £450k – £500k | £12.5k – £15k | £0 | £12.5k – £15k |

| £500k – £925k | £15k – £36.3k | £0 – £21.3k | £15k |

You can find out more about the Stamp Duty holiday in our recent article here or on the government’s official website here.

Here’s What Simon Butler, The Head of Mortgages at CMME:

“As the chancellor plans to extend the stamp duty holiday, this can only be a positive thing for those caught short by the previous announcement. In particular our self-employed client base has struggled to take advantage due to the IR35 implementation and uncertainty around renewals of contracts and job security.

The key reason for suggesting moving with haste is that there is currently no clear sign the extension will cover a full three months for all applicants. As a positive for self-employed that can now see a clear path forward, in terms of securing work and mitigating concerns after settling their post-IR35 affairs, this news provides a chance to take advantage of the holiday.

The timing also coincides with mortgage lenders offering a larger range of 85-90% mortgage products, along with reductions in interest rates to entice buyers back to market.

Many of us will be watching with keen interest to hear what else the Chancellor has in store for the next 6 months. It is hoped that further financial incentives will be offered to boost the economy, as national optimism hesitantly returns with the Governments lockdown exit plan taking shape”.

What Else?

As well as an extension to the stamp duty holiday, the government have a potential plan in place for a mortgage guarantee scheme, for reference this will likely mean:

- Borrowers can purchase at 95% up to a property value of £600,000

- The Government will guarantee a portion of the loan to aid lenders in mitigating risk

- It’s for all borrowers to access, not just first-time buyers

- It can be used on older properties, similar to the previous Help to Buy 2 scheme

The chancellor has already stated he will do “Whatever it takes” to ensure the future of the economy and the introduction of several schemes for the property and mortgage market could ensure current and potential home owners do not have to derail their plans due to the pandemic.

Useful Resources

- Getting A Mortgage For Company Directors | CMME Explains

- 2021: The Year Ahead For Contractors | CMME Explains

- Don’t Let IR35 Changes Derail Your Mortgage Plans: Here’s How | CMME

Whether you want to talk specifics or are just after some general advice, CMME can help. Speak to us today on 01489 223 750 for a completely free, no-obligation mortgage consultation. Or click the button below.