January 16th, 2024

In our last article, the UK base rate was the topic of discussion, alongside various major lenders engaging in a price war surrounding their mortgage rates to start the new year. This week, the UK inflation rate takes centre stage as leading forecasters such as Oxford Economics, project that the inflation rate is expected to half to 2% by April.

This continued decrease from the end of 2023 holds promise for independent professionals and contractors, influencing mortgage rates and opening doors to enticing deals.

Status Quo from 2023 to Now

As mentioned in our 2023 Review, The Consumer Prices Index (CPI), fell to 3.9% in towards the end of last year. In 2024, it is anticipated to drop even further, to below 2% within the next four months.

The catalyst for this decline lies in the unexpected slump in energy prices and the cost of oil on international wholesale markets. This accelerated decrease in inflation has prompted discussions at the Bank of England, possibly leading to an earlier-than-expected interest rate cut.

The independent forecasters’ revised outlook suggests a lower inflation trajectory for 2024. This shift challenges previous statements by members of the Bank of England’s interest rate setting committee, who had indicated that lending rates would remain high throughout the year to curb rising prices.

The recent predictions indicate a possible interest rate cut as early as April, with the potential for multiple cuts throughout the year.

Mortgage Rates and Contractor Deals:

For independent professionals and contractors, these inflation developments have a direct impact on mortgage rates. The recent fall in market interest rates has led to a significant reduction in the cost of mortgages, as noted by Bank of England Governor Andrew Bailey.

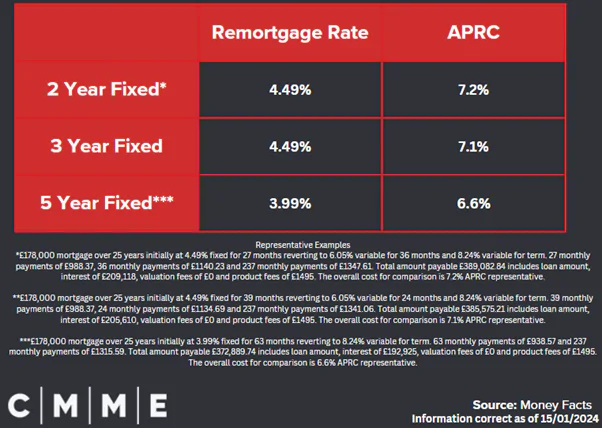

The hope is that this trend will persist, providing relief to individuals navigating the housing market. At the time of writing, below are the best existing remortgage rates*.

CMME Mortgages stands out as a valuable ally for contractors and freelancers in this evolving landscape.

With a commitment to understanding the unique financial situations of independent professionals, CMME Mortgages can guide individuals toward securing the right mortgage for their needs. As market dynamics shift, having a reliable partner becomes even more critical.

Optimism in the Market:

The positivity extends to the rates for mortgages fixed over five years, which have experienced a notable decline. This decline is linked to growing optimism surrounding the anticipated fall in inflation.

Despite concerns about potential inflationary pressures, such as disruptions in the Suez Canal and increased shipping costs due to the conflict in the Middle East, investors appear confident in the decreasing trend.

Energy and fuel prices on international wholesale markets have also played a role in the overall decline in inflation, positively impacting the costs of heating and transport.

Additionally, the expected steep fall in food prices, influenced by reduced transport costs, adds to the overall positive outlook for the year ahead.

In conclusion, as the UK experiences a decline in inflation rates, independent professionals and contractors find themselves at the forefront of promising opportunities.

With the potential for lower mortgage rates and attractive deals, coupled with the expertise of CMME Mortgages, navigating the evolving financial landscape becomes a journey filled with optimism and promise.

Book your FREE initial no obligation call with one of our broker’s today and get all the information you need as you dive into the mortgage market in 2024. Your home may be repossessed if you do not keep up repayments on your mortgage.