December 20th, 2023

In a year marked by unprecedented economic shifts, the mortgage market in 2023 has proven to be a roller coaster ride for borrowers and homeowners alike.

This article looks to summarise several events that defined the year in the mortgage and property space. These include:

- Fluctuating interest and base rates – Steady increases followed by a prolonged period of stability. We dive into base and interest rates throughout the year and how they will affect potential and existing homeowners.

- Transformative government reforms – King Charles III made a memorable statement in Autumn which aimed to make homeownership more affordable nationwide.

- Chancellor’s 2023 Autumn Statement – Jeremy Hunt’s statement left many yearning for more when it came to developments in the housing market. There were however some announcements that are applicable to the housing sector and are important for CMME clients to know.

We also look to forecast what 2024 has in store, in the hopes of providing useful guidance as you take your next step on your property journey.

Base Rate Stability Offers Respite for Borrowers

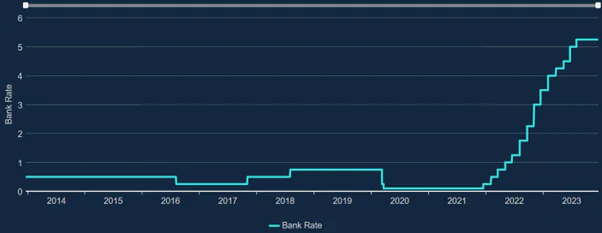

2023 saw a gradual increase in the base interest rate throughout the year, this being the percentage that is considered a benchmark for lenders’ interest rates. The number initially rose to 4% in February.

Then in May, in an attempt to curb the high inflation rates, the percentage rose to 4.5%. The idea is that higher interest rates make borrowing more expensive, which can reduce consumer spending. Consequently, decreased demand can help control inflation.

The public didn’t have much time to process this, as just one month later in June, the rate soared to 5%; a substantial factor which impacted people’s monthly mortgage repayments and borrowing costs.

The final increase came in August of this year, and since then, the base rate has remained at 5.25% to see out 2023. The four months without movement to finish off the year implies current stability in the mortgage market.

Source: Bank of England database

While it may take time for the base rate to go down again, it connotes optimism for the future as the high rates will likely lead to less borrowing in the short-term, thus demand will do down and reduce inflation rates. Back in our September 21st blog on this topic, Simon Butler, Head of Mortgages at CMME, emphasised the importance of careful consideration of financial situations despite the temporary relief.

For variable-rate mortgage holders, the decision means potential stability in monthly repayments, offering reassurance for now. However, vigilance is advised as future rate increases could impact repayments. Fixed-rate mortgage holders, on the other hand, will not experience immediate changes, but planning for potential adjustments post-fixed term is essential.

King Charles III’s Transformative Leasehold Reforms

One of the noteworthy addresses in Autumn came from King Charles III, who unveiled significant leasehold reforms aimed at making homeownership more affordable and seamless. The reforms include ground rent caps, transparent pricing, streamlined lease extensions, and legal protections, all designed to empower CMME clients and transform the dream of homeownership into reality.

The government’s commitment aligns with CMME’s mission to simplify financial processes for non-standard employment arrangements, providing much-needed support to those who have felt the constraints of the leasehold system for too long.

Chancellor’s Autumn Statement: A Mixed Bag for Property Market

The Chancellor’s Autumn Statement in November left many feeling there wasn’t necessary provision made for the housing market, with main focusses of the speech being the economy, inflation, public spending and tax.

There was however some consideration to the housing sector. Notable highlights include a 2% cut in employee National Insurance Contributions (NICs) aimed at improving affordability. However, concerns linger about whether this cut alone is sufficient to address housing affordability challenges.

For self-employed individuals, changes to the National Living Wage and ongoing reviews of IR35 rules present considerations for budgeting and payroll management. The decision to maintain the current VAT registration threshold at £85,000 for an additional two years brings relief to small business owners, including many CMME clients.

The extension of the Mortgage Guarantee Scheme until June 2025 was generally welcomed but accompanied by concerns about limitations, such as restricting qualifying loans to 4.5 times income. The removal of the cap on Local Housing Allowance aims to support private renters, yet critics question its adequacy in addressing renter challenges.

Mixed Reactions to Stamp Duty and Planning Reforms

Notably absent from the Autumn Statement were anticipated announcements on Stamp Duty reforms, disappointing some industry experts. The absence raises questions about potential additional costs for homebuyers and the overall effectiveness of the statement in providing comprehensive support to the UK property market.

While measures to boost house building and extend the Mortgage Guarantee Scheme were viewed positively, the industry looks ahead to potential announcements in the Spring Budget to address broader challenges faced by homebuyers and the property market.

CMME continues its dedication to helping clients navigate their finances in an ever-changing economic landscape.

Looking Ahead to 2024

As we stand at the cusp of a new year, the forecast for the 2024 mortgage market presents an optimistic landscape.

Whilst Economists polled by Reuters had forecast the Consumer Prices Index to fall to 4.4%, the surprise of the day has been a significant drop in CPI to 3.9% compared to 4.6% in the previous month.

It’s fair to say that a sense of optimism is viewable amongst commentators, who are seeing the Bank of England’s 2% target a more manageable one.

This alongside the BofE’s decision to hold the base rate at 5.25%, means that we can only wait and see whether the early Christmas present of improved inflation will be the gift that keeps giving, and thus translate in to improved borrowing rates early in the new year.

Lastly, we want to wish all our customers a Merry Christmas and a very Prosperous New Year from the Team at CMME. There’s still time to enter our competition to win your mortgage paid for a year up to £25,000 *, and you can still book an initial free consultation with us to discuss your situation and mortgage needs with one of our expert advisors. See below our temporary opening times for throughout the holiday period.