January 20th, 2021

Mortgage Plans? We’re here to help

When it comes to your mortgage plans for 2021, there are a number of ways you can give yourself the maximum chances for success within the process. With a buoyant mortgage market, the stamp duty holiday still to benefit from and the historically low interest rates still evident this year – 2021 could be the perfect year to action your mortgage plans.

In 2020, the average mortgage of a First Time Buyer in the UK was £194,000 however that figure rose to £354,400 when specifically looking at First Time Buyer mortgages in London.

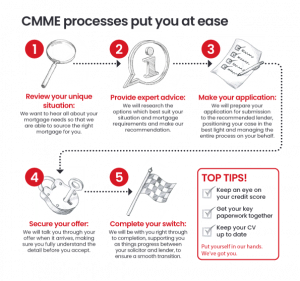

As experts who have been helping contractors and self-employed professionals like yourself for over 15 years, we’ve compiled a list of steps you can take to smooth the process from start to finish.

![]()

1.Check your credit report

Lenders have become increasingly risk-conscious and are continually on the lookout for reasons not to lend. A good deposit and a satisfactory income is often not enough to secure a mortgage.

That is why it is essential to keep your credit rating up to scratch, leaving the lender no reason to turn you down. It’s important to note that a poor credit score does not guarantee that you will not be approved for your mortgage application – in the same way, a good score does not guarantee approval – though a strong credit score is the first step towards approval.

Check out CMME’s free guide on credit rating

2. Improve your credit score

In light of step one, step two is applying the knowledge that is gained in being aware of your credit score and what sits on your credit report.

Here are some quick tips for improving your credit score:

- Register on the electoral roll

- Check for any errors and have them removed

- Pay off existing debt

- Don’t do lots of credit checks

- Pay your bills on time, don’t miss payments

Try an app like Credit Karma for keeping track and finding tips for improving your credit score.

3.Decide on your budget

In light of Coronavirus, many lenders have reduced the availability of high Loan-To-Value (LTV) mortgages meaning that you will often require a higher deposit than you may have previously, somewhere in the 10-15% range is more prevalent than a 5% in the current climate.

Lenders tend to favour individuals who have higher deposits, but this is true to anyone looking for a mortgage and not just contractors.

To access the most competitive rates you should be aiming to save anything between 10 and 25%. There are mortgage options out there for less than that, but they will be on a much higher rate.

We asked our experts everything you need to know about deposits, check it out here.

4.Get your paperwork sorted

You will need to provide minimal documentation to support your application. Ensure your CV is up to date as it will be used to prove your skills and experience.

The average time spent looking at a CV by recruiters is only 5-7 seconds.

You will also need to obtain a copy of your current contract as this will be used to demonstrate your earnings. Using both of these documents we can avoid any issues to do with affordability.

Our process is a simple as that. We won’t ask you for heaps of documents we might not need, we know the way you work, and we’ll make the process as easy as can be.

We asked our experts everything you need to know about documents, check it out here.

5.Investigate the market

Before you start your mortgage process, it’s a good idea to have a look at the market – investigate what type of mortgage might suit you and your needs, what area would suit you and the costs associated with your new mortgage and property.

Whether this is your first mortgage or your fifteenth, preparing in advance can help make sure your goals are realistic and achievable.

For an idea of what’s coming up this year for contractors, which might affect you and your mortgage plans, take a look at our recent article here.

6.Speak to a specialist

The truth is that most lenders have little understanding about the contracting market, and as a result, their standardised procedures do not accommodate contractors.

We have agreed bespoke underwriting agreements with a comprehensive range of lenders enabling us to secure mortgage funding based on a multiple of your contract rate alone.

![]()

Useful Resources:

- Progressing Your Mortgage Plans Amid Lockdown 3 | CMME

- CMME’s free guide to Contractor Mortgage

- Contractor Mortgage, Calculators and Tips for 2021 | CMME

Whether you want to talk specifics or are just after some general advice, CMME can help. Speak to us today on 01489 223 750 for a completely free, no-obligation mortgage consultation. Or click the button below.