What Happens If a Contractor’s Income Stops Mid-Mortgage?

January 28th, 2026

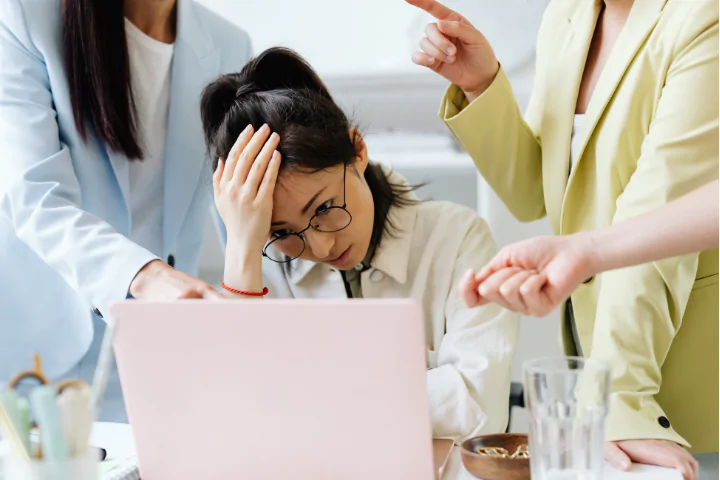

One of the biggest worries contractors have when taking out a mortgage isn’t getting approved – it’s what happens after.

More specifically: what if my contract ends and my income stops while I’m ... Read More