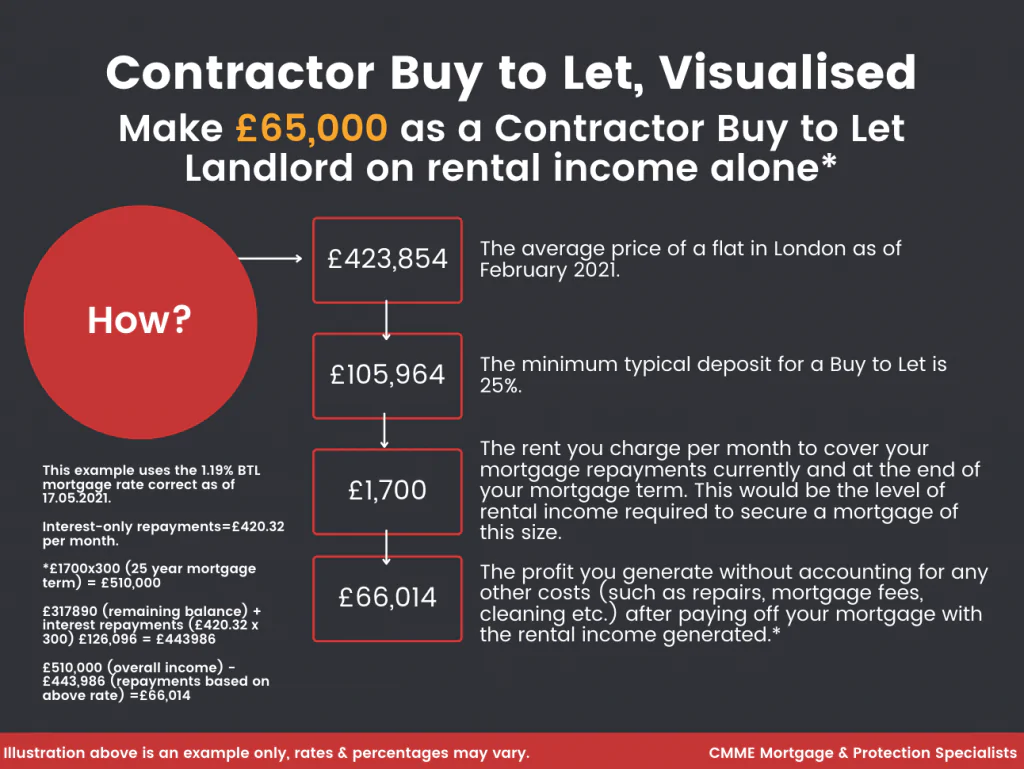

Being a Contractor Landlord is not only a way to expand your property and investment portfolio but also to give you a passive income alongside your main source of income.

Buy to Let mortgages are usually more expensive than regular mortgages, and because of the nature of letting, can be a risky business in terms of earning potential.

However, with the right information and guidance, investing in a Buy to Let property can be the perfect way for a contractor to boost income.

Our comprehensive Buy to Let mortgages guide covers the most important points to consider when embarking on a Buy to Let contractor mortgage.

You can also take a look at more details on our Q&A section about buy to let mortgages

Most Buy to Let mortgages offered by lenders are Interest-Only, which means you don’t pay anything on the lump sum of the money borrowed, only the interest, and pay back the outstanding amount at the end of the term.

If becoming a landlord is something you have been thinking about there are certainly a number of reasons to pursue this goal further.

As with any large financial decision, it is important that you consider all the implications this decision will have before you set anything in stone.

Thinking about becoming a landlord? With an idea of the monthly rent, you could charge you can get an estimate of how much you can borrow for your buy to let property. Try it today.

To get more information or to speak to our expert team contact us on 01489 555 080or email us at enquiries@cmme.co.uk

To download your own version of this guide with even more information and tips please enter your email below.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |