More choice and better value for you. Meet our specialist lenders

A contractor mortgage is likely to be the biggest financial commitment that you will ever enter into. The process can be long and daunting, but one thing it does not have to be is difficult.

When lenders assess a contractor mortgage, they will want to verify income by seeing two to three years’ worth of accounts or tax returns. Lenders have not kept up with changes in the labor market, and their criteria, in many circumstances, fail to accommodate for the growing ranks of independent professionals.

Umbrella company contractors will find that many of their expenses will not be considered when calculating income. Limited company contractors will experience a similar problem, as any money retained in the company, for tax purposes, will also not be considered. Both ways of operating are likely to lead to less borrowing power.

Choosing a specialist mortgage broker is vital if you want to avoid the hassle of dealing with lenders who do not understand the contracting world and your complex remuneration structure.

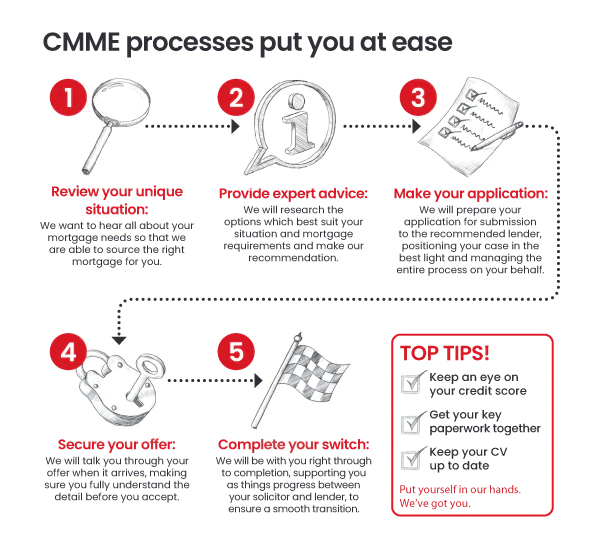

Your dedicated mortgage broker will do the hard work for you:

We’re here to help contractors and other independent professionals get the mortgage they deserve. Call us on 01489 223 736.

Alternatively, fill in your details below and one of our Specialist Advisers will call you back at a time that’s convenient for you.

*Mortgage rate accurate as of 10/08/2021

Overcome the hurdles with our expert advice, see what CMME can do for you.

Arrange a free consultation with one of our specialist

Request a call back today.